The Fair Tax Act Returns in 2025! Will It Abolish the IRS?

February 11th, 2025 | 6 min. read

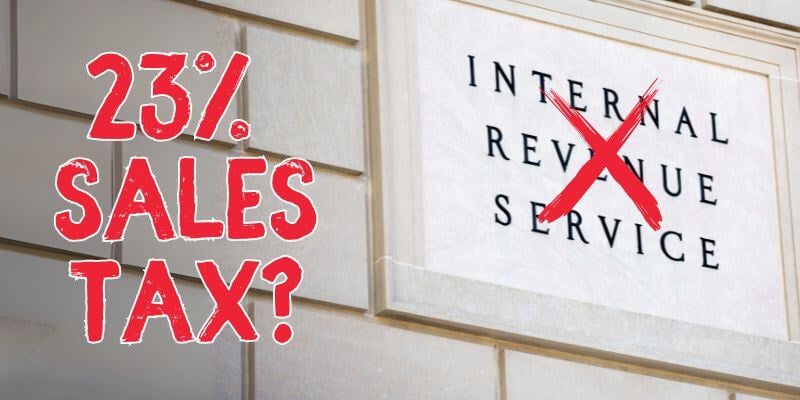

Imagine replacing income taxes, payroll taxes, and more with a national sales tax… meaning no need for the Internal Revenue Service. Is this even possible in our economy? Well, it’s being proposed!

Representative Buddy Carter has recently been back in the headlines with another push for The Fair Tax Act, which could have the ideal outcomes mentioned above. However, there are some downsides, too. Let’s talk about The Fair Tax Act and its likelihood of passing.

At CSI Accounting & Payroll, we’ve provided small businesses with monthly accounting and tax services for nearly 60 years. That means we’ve seen a lot of tax laws take shape – and many more never come to fruition. Here’s how we would answer:

- What is The Fair Tax Act?

- Will The Fair Tax Act pass? Why or why not?

About The Fair Tax Act

A handful of representatives have been fighting for The Fair Tax Act and its concepts for decades now (since 1999), but Buddy Carter has reintroduced it in January 2025.

If it sees the light of day, what will happen?

As it’s proposed, it would be the most radical tax reform in the history of the United States. It would directly do these three things:

- Abolish income, corporate, estate, and payroll taxes. You will keep 100 percent of your paycheck. In turn, this abolishes the IRS.

- Replace the taxes above with a 23 percent national sales tax on nearly all unnecessary goods and services – collected at the point of sale. This would affect everyone, even non-citizens.

- Establish a monthly prebate for legal citizens to offset the cost of necessities. Check amounts will vary by family size and poverty level, allowing the purchase of necessary goods – like food, shelter, and medicine – essentially tax-free.

How does this sound? Many get stuck on the 23 percent sales tax and don’t give enough credit to the prebate’s benefits for necessary goods.

However, there are more implications to consider that will contribute to The Fair Tax Act passing or failing. Let’s talk about them!

The Fair Tax Act: Pass or Fail?

As mentioned earlier, The Fair Tax Act has been introduced and reintroduced for decades. It hasn’t passed yet – and we don’t think it ever will. However, we still want to address:

- The pros, or why it may pass

- The cons, or why it may fail

Pros (Why It May Pass)

Representative Buddy Carter’s website addresses some common misconceptions about The Fair Tax Act. It mentions that:

- Retired individuals living on a fixed income will benefit, too. They will not pay income tax on Social Security benefits, investment income, pension benefits, and IRA withdrawals.

- Embedded costs on the purchase of a new home are eliminated. This means the cost can fall relative to the price of construction and compliance. Mortgage interest rates may also drop.

- A family of four could spend $30,000 annually without paying a penny in taxes. This is an example of the power of the prebates (as currently proposed).

- It will save small businesses the cost of continued compliance. This can make it easier to start and grow a business.

Despite all of these pros, why are we still skeptical? With many of the pros, there’s also a “but…” – and those need to be addressed. Let’s do that now!

Cons (Why It May Fail)

Because of the number of times the concept has been shut down by Congress, we mostly think The Fair Tax Act won’t pass due to its lack of bipartisan support and lack of support from President Trump.

Trump has stated that he actually wants to expand taxing efforts by establishing an ERS (External Revenue Service), and since the IRS employs nearly 100,000 people, taking it down is no small feat.

What are the other reasons why these officials aren’t fans of The Fair Tax Act? Here are some notable cons:

- It lowers the average person’s purchasing power of “unnecessary” goods and discourages spending in that area. If that happens, our government may struggle to collect enough taxes.

- The prebate has limitations and may benefit the wealthy more. Some critics state that even with the prebate, it may not offset the 23 percent sales tax enough for low-income households.

- Small businesses will have new challenges. While small businesses will save on payroll taxes and tax preparation, they’ll face higher prices for raw goods and for retailing products. They may also struggle to show their value with the 23 percent sales tax on top of it – becoming a victim of the reduced spending for “unnecessary” goods and services.

Taxes (And Tax Strategy) Are Here to Stay!

Even though we don’t believe The Fair Tax Act will ever pass, we still think it’s important to talk about proposed tax laws that you hear about in the news. This one highlights the fact that accountants are here to stay, and they can continue to help small businesses with tax strategy to legally minimize what you owe.

Now that you know what The Fair Tax Act is, plus the pros and cons (and why we think it won’t pass), are you ready to check out monthly accounting services?

If so, please consider CSI Accounting & Payroll! To see if we can be a good fit for your business, click the button below for a free consultation:

Not ready to talk? That’s okay! First, learn more about what it’s like to work with us by clicking the image below:

Brian began working at CSI in 1996, and he purchased the business in 2002. As Owner, his primary role is in the management and growth of the firm. Since 2002, the firm has more than quadrupled in size. In 2009, Brian started CSI’s payroll service to complement CSI’s accounting and tax services. Brian received his Bachelor’s degree from the University of North Dakota, with a double major in Accounting and Financial Management. He’s a member of both the National Society for Tax Professionals and the National Society for Accountants, and he serves on the board of directors for the Professional Association of Small Business Accountants, where he was once president. Brian also serves on the business advisory council for Opportunity Partners, an organization that helps people with disabilities find employment. He’s also contributed to several business books, including Six Steps to Small Business Success and The Lean Mean Business Machine. Fun Fact: To help put himself through college, he used student loans, delivered pizzas, and worked summers in a salmon processing plant in Alaska.