How Do I Find My Small Business's Break-Even Point?

July 19th, 2023 | 7 min. read

When you own a small business, you need to be aware of your financial health. This is done through tracking KPIs (Key Performance Indicators).

An important KPI that's easy to calculate on your own is your break-even point. This shows what it takes for your business to be profitable, and it's especially valuable to product-based businesses (to analyze their different sale points and different numbers of units sold to break a profit) and startups (to see if their business is viable or if they're losing money each month).

At CSI Accounting & Payroll, we've become experts at small business monthly accounting over the past 50+ years. That means we know the importance of tracking crucial business KPIs like your break-even point - and analyzing it to look at different scenarios. In this article, we cover:

- What is a break-even point, and why is it important?

- How do I calculate my break-even point?

- How do I conduct a break-even analysis?

- What are other crucial KPIs, and how can I track them?

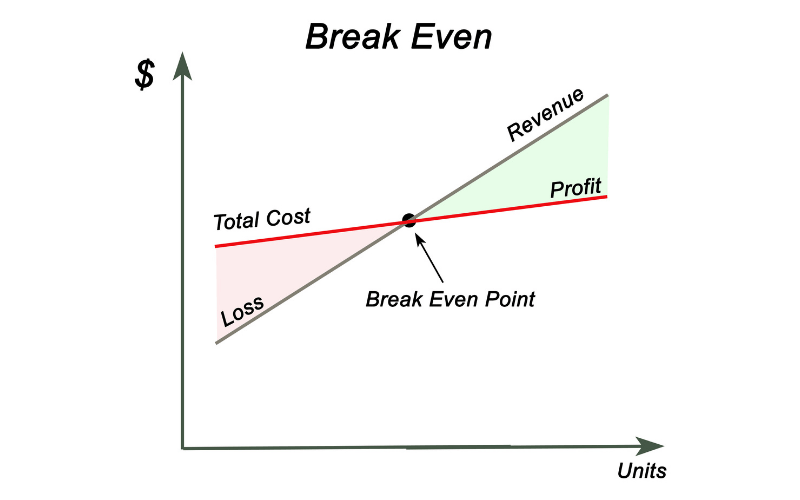

What a Break-Even Point Is

Your break-even point is the point in your production when you neither lose any money nor make a profit. It's immediately after this point when your business will start to become profitable. Your break-even point answers this one crucial question; how much do I need to generate in sales for my company to make a profit? The SBA says that businesses should find their break-even point to:

- Obtain funding

- Analyze costs

- Evaluate profits earned at different sales volumes

- Prove their potential turnaround after disaster scenarios

How to Calculate a Break-Even Point

Calculating your break-even point is complicated because it fluctuates depending on variable expenses and profit margins, but you still need to track it as closely as you can. Use this formula to find what you need to do to turn a profit:

Break-Even Point = Total Fixed Cost / (Average Price - Variable Cost)

If you're having trouble with the formula, an accountant at CSI can help you as part of the unlimited advice included in monthly accounting. When you work with us, you meet with your dedicated accountant monthly to go over your finances. You won't be charged by the minute, and you can reach out any time!

Do you want a deeper dive into your break-even point? Are you not sure what the formula is telling you? An accountant can conduct a break-even analysis for you.

How to Conduct a Break-Even Analysis

An analysis could include looking at various different scenarios that would have different variables. If you have a product-based business, for example, several different break-even point scenarios can be created based on different sale points and different numbers of units sold. It can be used to:

-

Price Smarter. Knowing how pricing affects profitability helps you price your products smarter.

-

Catch Missing Expenses. You can lay out all of your financial commitments, limiting surprises.

-

Set Revenue Targets. Know how much to sell to be profitable, so it's easier to follow through.

-

Make Smarter Decisions. Limit decisions made on emotions and help you base things on facts.

-

Limit Financial Strain. Limit the financial toll of a bad idea via analysis of potential outcomes.

-

Fund Your Business. Usually required to take on investors / debt and proves your plan is viable.

An in-depth break-even analysis can be very high-level, so many business owners will not be able to effectively do this themselves. While an accountant at CSI can help you with the equation to find your break-even point for no additional fee, a break-even analysis would be considered an add-on consulting project and subject to an additional fee.

Other Crucial KPIs to Track

This checklist covers seven basic KPIs you need to measure to ensure your business is profitable and in good financial health. The information will help you analyze your profits, streamline your operations, and improve efficiency. Each company is unique, which is why the KPIs we discuss are not meant to be definitive.

With this FREE checklist, you'll learn how to identify and calculate important metrics for your business, including:

- Break-even point

- Customer acquisition cost

- Customer lifetime value

- Gross profit

- Net profit

- Total revenues

- Average revenue per employee

Turning a profit is easier said than done. To boost your bottom line, you need to know your financial moves and KPIs at all times. That includes your break-even point in varying situations! If you don’t have time to do it yourself, partner with a monthly accounting service like CSI Accounting & Payroll.

We'll simplify your life and give you more time to focus on business operations. You'll get a profit and loss sheet, balance statement, and accurate account reconciliation every month, ensuring that you have the financial information to make the best choices for your company.

Click the button below for a free consultation to see if we can be a good fit for you:

Not ready to talk? That's okay! First, learn more about what it's like to work with CSI by clicking the image below:

This article was composed by a member of our staff who interviewed our experts to get the facts straight. Any uncited information found here came straight from a knowledgeable accountant or payroll specialist. We are dedicated to being a source of information and do not plagiarise from AI or other sites.