How to Qualify For the ERC: Industries Most Affected

July 20th, 2022 | 6 min. read

How can you tell if your business is eligible for the Employee Retention Credit (ERC)? The requirements for it have gotten more difficult to meet over time, so it can be hard to tell if you can apply.

The good news is that since you know that the ERC exists, you’re already a step in the right direction. The bad news is that when so many others are uninformed about the ERC, you’re not able to use your small business community as a resource to get your questions answered.

Luckily, CSI Accounting & Payroll has helped many of our eligible clients claim the ERC, so we’re able to walk you through the following:

- Which industries are most likely to be eligible?

- Are you eligible for the ERC?

- How do you claim the ERC?

Industries Likely Eligible For the ERC

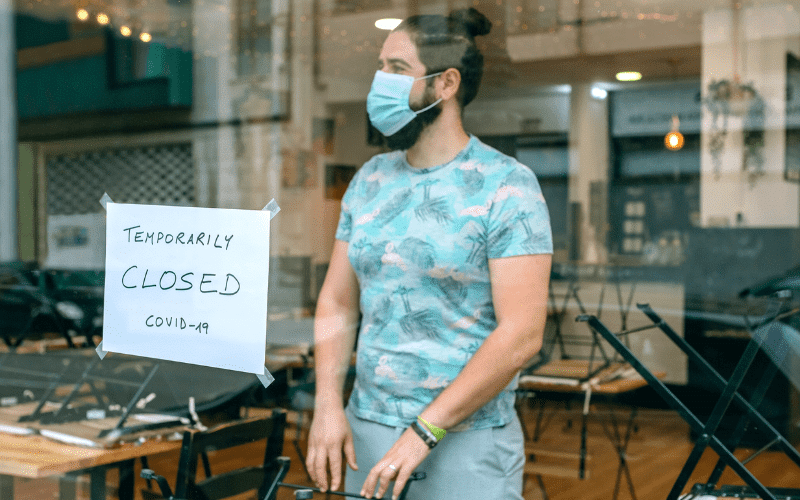

If you read into the eligibility requirements for the ERC, one thing that stands out for almost all of the quarters is a business being shut down while still paying out wages to employees. Therefore, a simple way to see if you might be eligible is if your industry was ever subject to a government shutdown!

Here are some industries that were subject to COVID shutdowns:

- Restaurants and bars

- Entertainment venues, banquet rooms, and pool halls

- Spas and salons

- Hotels and other hospitality

- Gyms

- Daycares

You’re not automatically eligible for the ERC if you fall into the list of industries above, and you can also still be eligible if you don’t fall into these industries. The following section goes into more detail.

Who is Eligible For the ERC?

To get an idea of if you may be eligible for the ERC, check out the following criteria.

2020 ERC Eligibility

- You were in business before February 16, 2020.

- You have 500 or fewer W-2 employees.

- A quarter in 2020 has sales down by at least 50% of the corresponding quarter's in 2019 OR your business was subject to a full or partial shutdown order in this quarter, and you paid out wages to your employees while it was shut down.

Q1 & Q2 2021 ERC Eligibility

- You were in business before February 16, 2020.

- You have 500 or fewer W-2 employees.

- Q1 and/or Q2 2021 sales are less than 80% of the corresponding quarter's in 2019 OR your business was subject to a full or partial shutdown order in this quarter, and you paid out wages to your employees while it was shut down.

Q3 2021 ERC Eligibility

- You have 500 or fewer W-2 employees.

- You were in business before February 16, 2020 OR you have under $1 million in sales.

- Q1 and/or Q2 2021 have sales down by at least 90% of the corresponding quarter's in 2019 OR Q1 and/or Q2 2021 sales are less than 80% of the corresponding quarter's in 2019 OR your business was subject to a full or partial shutdown order in this quarter, and you paid out wages to your employees while it was shut down.

Q4 2021 ERC Eligibility

- You have 500 or fewer W-2 employees.

- You were not in business before February 16, 2020.

- You have under $1 million in sales.

How Do You Claim the ERC?

Have a reputable company file for the ERC for you! Here’s why: you may be held liable for incorrect claims. We foresee small businesses going through audits and having to pay back incorrectly distributed credits - plus penalties and interest.

As we mentioned before, you should be wary of baseless claims from shady companies who say they can get you the ERC if they know nothing about your business’s performance during COVID. The IRS will accept returns from anybody - even if they’re not your agent - as long as they know your EIN and name. We have seen other companies take shortcuts in submitting information, causing issues for small businesses.

You should also avoid trying to do it yourself if you aren’t confident in the information you’re submitting.

So, what makes a company reputable for helping small businesses claim the ERC? Documentation and strategy.

At CSI Accounting & Payroll, we use a detailed spreadsheet to categorize all of your relevant information, and we hold onto this information in case it is ever needed for an audit. We also use it to strategize with every dollar spent, maximizing what you can receive in COVID relief funds. This information is shared with you; we’ll never keep you in the dark or make promises that we can’t fulfill!

Keep Up With COVID Relief Funds’ Changing Eligibility

CSI Accounting & Payroll stays on top of the ever-changing eligibility requirements for COVID relief efforts to help our clients - and others - through this difficult time. Relief money means anything from recovering from a financial loss to helping your business keep its doors open!

Even after the ERC has come to a close, we are dedicated to helping eligible small businesses claim their credits for previous quarters.

Not to mention, coming on board as a monthly accounting client has tons of benefits over just annual tax accounting or even hiring an in-house accountant. To learn more, click the button below for a free consultation.

Not ready for a discussion yet? Read more about what goes into a monthly accounting fee by clicking the button below:

Bret is the Chief Operating Officer at CSI Accounting & Payroll, a role he stepped into in 2024. He began his journey with CSI in 2007, starting in a marketing position and eventually becoming the Payroll Department Manager, where he played a key role in helping CSI's expansion and long-term success. His background in sales and management – along with a degree in Computer Networking and Certified Payroll Professional (CPP) title – continues to serve him well in a dynamic environment as he leads the way for our Minnesota office.