Top Three Accounting Best Practices for Restaurants

March 1st, 2023 | 6 min. read

Looking out over a crowded dining room is one way to measure success in the restaurant industry, but it may not be the most effective benchmark to gauge profits. Profitable restaurants are backed by sound accounting practices and consistent reporting. What does that entail?

At CSI Accounting & Payroll, we've worked with restaurant owners for more than 50 years. That means we're familiar with best practices for your industry. We feel that the following survey is a good representation of what our restaurant clients have found success with.

A recent survey of independent restaurant owners asked its members a series of questions regarding the use and frequency of common accounting best practices, including:

-

Daily recording of sales and receipts

-

Detailed cost-recording of purchase invoices

-

Weekly food and labor cost reporting

-

Counting and computing inventory on a weekly or monthly basis

-

Tracking key inventory item usage on a daily or weekly basis

-

Designating key persons for accounting-oriented tasks

-

Using a POS system for tracking time & attendance

From the survey, three accounting best practices stood out among profitable restaurant owners:

1. Maintain a monthly financial profit and loss statement.

While monthly financial statements are a good idea for any small business, it's especially important for restaurant owners to be on top of the data if they're doing a lot of business. According to the survey, 73% of the operators that received monthly financials reported being profitable.

On the flip side, only 49% of respondents that received just quarterly or annual statements were profitable. If you work with an annual tax accountant, you'll only receive statements annually.

2. Report food and labor costs on a weekly basis.

It’s no surprise that food and labor costs are the largest thorns in restaurant owners’ sides; they typically account for between 55-65% of revenue. Monitoring food and labor costs (also referred to as prime cost) compared to sales on a weekly basis helps you recognize red flags before they become larger issues, such as:

- Overstaffing

- Excess food waste

- Food costs increasing

- Food waste increasing

- Inconsistent portion sizes

In fact, 75% of operators that monitored weekly prime cost reported being profitable.

3. Count and compute inventory on a weekly or monthly basis.

Keeping track of inventory in a bustling restaurant can be tedious at times; however, 72% of operators in the survey that do an inventory at least monthly indicated that they were profitable. Doing inventory weekly is ideal to stay in line with tracking food costs but can be a laborious task, so we recommend it be done between weekly and monthly.

If you don't think tracking your inventory is important, keep in mind that only 58% of operators that don't compute inventory values reported that they were profitable.

Overall Findings:

The most telling statistic from the survey?

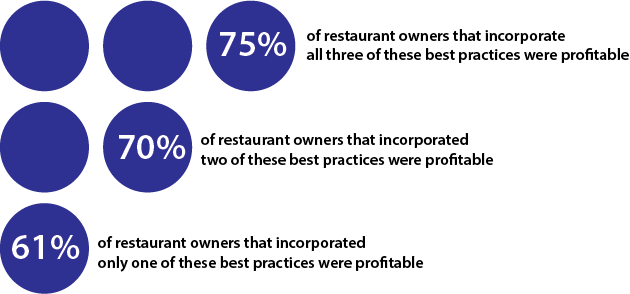

Only 29% of restaurants that didn’t do any of these accounting best practices were profitable.

Work With a Specialized Restaurant Accountant

Are you applying these best practices for your restaurant? Remember, 75% of restaurant owners who followed all three of the best practices above reported being profitable - it may be worth your time!

If you're not following them and aren't sure how to get started with increasing your profitability, consider working with an accounting firm that has experience in the restaurant industry. CSI Accounting & Payroll has worked with restaurant owners just like you for more than 50 years.

To find out if your business is a good fit to work with CSI, click the button below to schedule a free consultation:

Not ready to talk yet? That's okay! To learn more about gauging your business, download our restaurant profitability checklist.

Brian is the owner of CSI Accounting & Payroll. After earning a double major in Accounting and Financial Management from the University of North Dakota, he joined CSI in 1996 and purchased it in 2002. With decades of experience, Brian now focuses on education: contributing to professional associations and business books, actively participating in continued learning for his team, and, of course, sharing transparent insights on CSI’s website.